Founded in 2002, Enspyre is Taiwan’s leading B2B Lead Generation and Phone Answering company. Our company assists world leading enterprises in finding their business customers in Taiwan. We also provide professional phone answering services to small- and medium-sized companies so no business opportunities will be missed.

For over 20 years, like most companies in Taiwan we have been using traditional, handwritten receipts, so called “Fāpiào發票”. However, this process is not only time-consuming, but also expensive and waste a lot of paper and transportation costs. After collecting information for a long time, we decided to start using the E-Invoice Platform from the Ministry of Finance (MOF). We officially switched to using paperless e-invoices in September 2018.

Invoice or Receipt?

There is a confusion of terms here. What the Taiwanese government calls a fapiao in Chinese they translate into English as “Invoice”.

If you search Google in English for a definition of the word invoice you get:

This would imply that an invoice is something that you hand over BEFORE you get paid.

When you go to a store and buy something you hand over the money and they will hand you back a fapiao that shows how much you paid. In English most people would call this a receipt.

If you are a B2B company in Taiwan you most often send a fapiao to a client when you WANT them to pay (invoice) and this also acts as a proof of payment (receipt). Based on this receipt you pay taxes even if you have not yet received the money from the client’s money.

Keep this in mind when you read the rest of the article and we continue to use the term e-invoice.

Concerns over E-invoices

Since adopting the e-invoice, the time dedicated to administrative operations has been reduced and our clients can receive invoices in a more efficient way. There are nevertheless some challenges in changing such an important procedure. We are often asked the following questions:

- Since an e-invoice is not physically printed on paper, can it be used to deduct taxes?

- It seems rather troublesome and complicated to get ready to receive e-invoices? Is it worth the effort?

- How do I process an e-invoice received via e-mail?

- Should the e-invoice printing costs be transferred to the buyer?

- An invoice can be faked. How do I verify the authenticity of an e-invoice?

If you share some of the concerns listed above, then please read on. We are happy to share our e-invoice adoption experience, and why we see it being worth the effort.

Evolution of the E-Invoice in Taiwan

Nearly 20 years have passed since the Taiwan government first began to promote e-invoices. Trial runs of the first-generation e-invoices started in 2009. Since 2017, all the receipts issued by public sector entities have been replaced with e-invoices. By 2018, the government reports that nearly 7.2 billion e-invoices have been generated, which has saved nearly 72,000 trees worth of paper.

All major shopping malls, supermarkets, online stores, and state-owned enterprises like Taiwan Power Company, Taiwan Water Corporation, and Chunghwa Telecom have adopted e-invoices.

According to MOF statistics as of March 2019, 33,657 B2B enterprises and 60,412 B2C enterprises has adopted e-invoices. Excluding duplicate companies, the number of early adopters of e-invoices amount to 87,292 companies, or about 7% of all Taiwanese businesses.

According to the theory of critical mass, once the adoption reaches 10%, it should start growing exponentially. So perhaps by this time next year, the usage will hit 10% and then quickly become the mainstream invoice method? We certainly hope so.

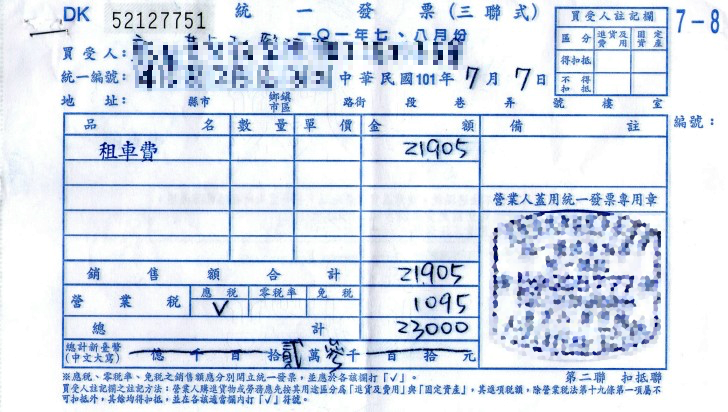

Paper Uniform Invoice Types

Before we jump into the discussion of the e-invoice, let’s do an overview of the old paper versions. Here are the four most common versions:

1. Triplicate Uniform Invoice (Carbonless Paper)

Handwritten by a business when they sell goods or services to another business that also have a Taiwan Tax ID Number (Tǒngyī biānhào統一編號). The first copy is the “stub copy” (reference copy), the second copy is the “deduction form”, the third copy is the counterfoil.

2. Duplicate Uniform Invoice (Carbonless Paper)

Handwritten by a business when they sell goods or services to individuals who does not have a Tax ID Number. The first copy is the “stub copy”, while the second copy serves as the counterfoil.

3. Cash Register Receipt (Paper)

The kind of receipt you get from the store’s cash register. You probably have a bunch of them in your pocket just this minute.

4. Computer Uniform Invoice (Paper)

Invoice printed out on a printer. Companies that sell a large number of products like furniture or home improvement stores often use this kind. Due to the large amount of paper needed, the government has explicitly banned its usage after 2020/1/1.

What is an E-Invoice?

In order to ensure that we are paying our taxes, every company has to purchase invoice books with unique, registered and sequential numbers from the government. If you are going digital you instead get your unique numbers online from the Ministry of Finance (MOF) online.

An e-invoice is a uniform invoice issued, transmitted, or received through the Internet or other electronic means. Its “stub” must be uploaded on the MOF e-invoice platform within a specific time limit. That means that the e-invoice you send to a customer can be verified from the MOF system that gave you the unique invoice number.

The e-invoice platform currently deals only with B2B e-invoices.

Safety Concerns

Information security is a main concern of every business owner, and also one of the key factors taken into account by Enspyre when considering using e-invoices. While implementing the e-invoice system, the MOF issued specific regulations on system security, which they say will keep all the data safe. We have chosen to believe them. If you want to know more, they provide a lot of more details on their website.

How to Implement e-invoices

There are several different ways to implement e-invoices according to the number of invoices you issue, type of trading parties, system development ability, and budget. Check out the table below and find the model which suits your company:

| Implementation Method | 1. Manually enter info to gov. platform | 2. Upload CSV to gov. platform | 3. Connect via 3d party software | 4. Develop API with your accounting system |

| Company Size | Microbusiness/ SME | Micro/ SME | SME/ Large | Large |

| Trading Type | B2B | B2B | B2B/B2C | B2B/B2C |

| Costs | Free | System Installation Costs | Monthly/ annual fee by the number of invoices | ERP System, government platform connection fee |

| Advantages | No need to install a system

Quick and easy to get started Fast data input |

Data easily remitted from the system

Supports batch uploads |

Low startup costs

Save admin labor 24-hour service system |

Integrated with internal system

High privacy, the safety of your information is guaranteed |

| Disadvantages | Entries have to be written and uploaded one by one, only feasible for small number of invoices | CSV file can only have 30 invoices at the time | Data are uploaded by a third party, the VAS Center

You share information with VAS |

Initially takes significant budget |

E-Invoicing and Accounting System Integration

Enspyre is currently using a self-developed accounting system and our monthly number of invoices are quite low. We have not yet tried to integrate our system with the MOF e-invoice platform so we enter all invoice information by hand one by one. Soon we will start uploading CSV files with all invoices for a period of time.

Enspyre’s partner company Wordcorp is a great translation company. Their monthly volume of invoices is much higher than Enspyre’s and as such they are using a third-party system to automatically connect their internal system with the government’s.

“We have been using digital fapiao for years. And we really love it. Every SME should consider using it,” says David Chang, founder of Wordcorp.

B2B E-Invoice Formats

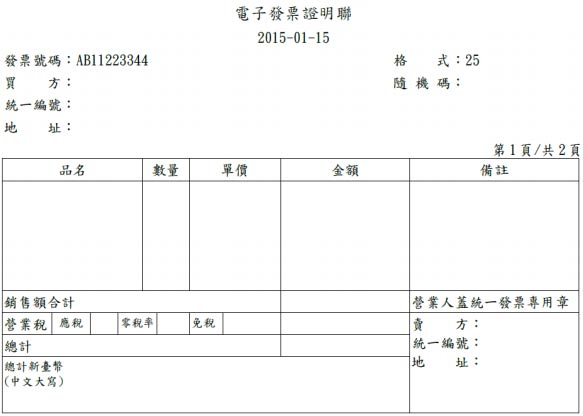

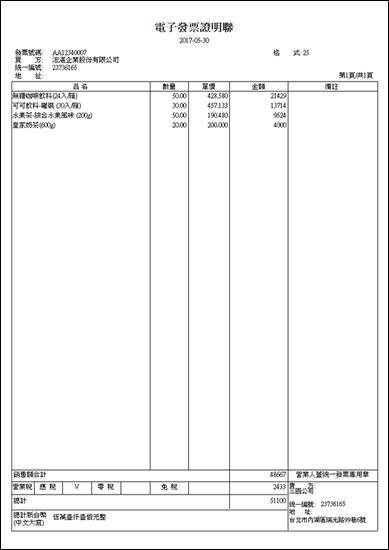

No matter what method you chose to use to upload your invoice info to the MOF system, it then creates a PDF version of the e-invoice that can be downloaded and sent to the customer and then they can decide if they feel like they need to print it out. You can choose among the following 3 formats:

1. 5.7cm long, 9cm wide, it has a barcode and a QR code

To ensure that the invoice is counterfeit-proof, the invoice details like invoice number and sales amount are accessible by scanning them with a QR scanning App. In print it will show you info like Tax ID Number of both supplier and customer, amount, taxation category, taxable amount, and notes.

2. A5 size, 29.7cm long, 14.57cm wide

This format looks very similar to the handwritten invoice with all the regular invoice information and space for notes.

3. A4 size, 29.7cm long, 21cm wide

This format looks like the large store-printed “Computer Uniform Invoice”. It is suitable for business entities who deal with a large variety of items that all need to be listed on the invoice.

How to apply to use B2B e-invoices

Now you know what an e-invoice is. We will now explain how to apply for it. It takes 2-3 weeks:

- To securely connect with government online systems, you need your Business Certificate which functions like an ID card for your company. You’ll input that into a card reader to identify yourself when logging into government websites. If your company don’t have one yet, you can apply for one at the Ministry of Economic Affairs Certification Authority (MOEACA). It takes around 7-14 days. Online Application: https://moeaca.nat.gov.tw/

- Apply for the E-Invoice Tracker Approval by sending the documents below to your local tax office. It takes around 3-7 days, then it won’t be necessary to regularly buy paper invoice books anymore. These are the documents you will need:

- E-Invoice Tracking Number Application

- Letter of Commitment to state you want to use the e-invoice

- E-Invoice System Opening Self-Test Form (If issued by the MOF Platform, no attachment needs to be provided)

- Affidavit for printing e-invoices with thermal paper (if issued by the MOF Platform, no attachment needs to be provided)

- Authorization to let the head office replace appointed branches when dealing with applications (if issued on the MOF website, instead of through the branch office, no attachment needs to be provided)

- If you will use a third-party platform to connect with MOF you need a Letter of Appointment to entrust the VAS Center (if issued by the MOF Platform, no attachment needs to be provided).

- Then you register for an account on the e-invoice platform: https://www.einvoice.nat.gov.tw/index

- Login using your credentials, then set up your profile

- Download the invoice tracker and invoice numbers from the platform

- Ready to issue e-invoices!

Comparing Handwritten and E-Invoicing Costs

So, what are the benefits of digitizing invoices? Is it worth all the effort to get started? Here is a comprehensive comparison:

| Task | Handwritten Invoice | E-Invoice | E-invoicing Benefits |

| Invoice numbers | Visit appointed institution to buy the invoice books | Get invoice number during the first login, then the MOF will automatically number the invoices through regular emails. | Seller |

| Save time and money, quick access to the invoice number | |||

| Buyer | |||

| Unaffected | |||

| Invoice issuance | Paper invoices requires multiple steps: handwriting, stamping, mailing, etc.

|

Issued directly online

The e-invoice can be sent directly by email Optional to print |

Seller |

| Speeds up payment process

Save paper & energy |

|||

| Buyer | |||

| Fast payment procedure

Fewer damaged, lost invoices |

|||

| Check invoice info | Handwritten info can be hard to read

If there’s a mistake or the stamp hasn’t been properly affixed, the invoice has to be canceled and issued again |

E-invoice info is clear, easy to identify

Enter VAT nr., system will add company info, then check & confirm sum |

Seller |

| Human errors due to handwriting is reduced

The system automatically calculates the amounts |

|||

| Buyer | |||

| No reading errors | |||

| Stamp | Each invoice must be stamped to be valid. | No stamp needed | Seller |

| Fast invoice issuance | |||

| Buyer | |||

| No worry invoice is invalid | |||

| Mailing costs v immediacy | Invoices aren’t timely delivered

During emergencies, even if scans are available, the paper will still be required Mailing costs Have to go to the post office to mail it

|

Invoice info accessed online

E-invoices sent to the buyer immediately No mailing costs Low risk to lost and returned |

Seller |

| Invoice immediately sent, no risk of losing or having to resend. Save time and postage

Faster payments |

|||

| Buyer | |||

| E-invoice quickly received & confirmed

Quick payment and reimbursement process |

|||

| Invalidating, depreciating | Many procedures to invalidate/depreciate an invoice incl. waiting for customer to return old invoice, then mail new invoice | The e-invoice can be invalidated or depreciated via the platform | Seller |

| Save time, mailing costs | |||

| Buyer | |||

| Save time, mailing costs | |||

| Storing info | Paper invoices which have already been issued take time to organize and take up space

Paper invoice are irregular size, they are difficult to organize. Consulting paper invoices is complicated & time-consuming. |

Invoice data is stored online

Unused invoice numbers only need to be uploaded on the platform before the 10th of the following month Invoice info can be quickly found & downloaded Easy to check, reduced auditing costs |

Seller |

| Reduce time for organizing, safeguarding, & checking

Manual maintenance time gets reduced. Fast retrieval & data check Saves costs, space for storage |

|||

| Buyer | |||

| Reduce time to store, organize, safeguard & checking

Fast retrieval & data check |

|||

| Data security | Data security and maintenance rely on manual labor and secure facilities.

Space for paper receipts storage |

Platform security is high, low risk of data breaches

Safe storage of the invoice data online |

Seller |

| Reduced safety, maintenance costs | |||

| Buyer | |||

| Reduced costs for safety, maintenance & storage |

From the table above, we can see how both the buyer and seller can benefit by switching to e-invoicing.

Do we save money by using e-invoices?

Let’s explore more how using e-invoices helps Enspyre to save money and time. It might not be exactly the same for you, but you get a general idea.

As a B2B company with long-term contracts, Enspyre issues about 100 invoices a month to our business customers. Previously we hand wrote every invoice. Soon we will be uploading invoice info in batches and we estimate we will save about 7 hours of work time per month.

We save on the envelopes and postage and sometimes courier costs for sending out invoices. We save about $3000 per month

We no longer have to go to the post office, wait in line and mail out the invoices, saving us about save 2 hours per month.

We save a whopping $32 on not buying 2 fapiao books per month.

We save about 4 hours per month preparing information for CPA since our information is already digital.

Time: 13 work hours/month

Money: $3032/month

We also save in the long run by not having as much paper to store

We have also noticed that our customers tend to pay their bill faster when they get an e-invoice which is of course also very nice.

If we had higher volume of invoices, we would connect our system with the government’s either via one of the established third-party systems or with a direct API and save even more time.

How much would you save?

Convincing others to use E-Invoice

Many enterprises are still used to use traditional paper invoices. In our experience, the bigger a company is, the harder it is for them to change its payment procedures. When dealing with this type of client, we do not have any choice but to send them the handwritten kind. We hope that with time, more enterprises will recognize the benefits of e-invoicing so we can handle all Taiwanese clients on the same platform.

Although Enspyre has almost completely digitized our own invoices, we still receive some traditional papers invoices for products and services we buy. For example, accounting firms are still required to use paper-based methods to handle government tax returns. Other companies think the system is still too immature.

Conclusion

If, like Enspyre, you are an SME B2B company which wants to simplify invoicing operations and save a bunch of trees then go to the MOF e-invoice platform today.

Enspyre has found that we save enough time, money and frustrations that it is worth it for us. As we grow, we can further streamline the process further.

You are invited to join us in the “e-invoice users club”, let’s do our best to save the Earth!